The 8-Second Trick For Hard Money Atlanta

Wiki Article

Some Known Incorrect Statements About Hard Money Atlanta

Table of ContentsFascination About Hard Money AtlantaHard Money Atlanta - QuestionsHard Money Atlanta - An OverviewThe smart Trick of Hard Money Atlanta That Nobody is Talking AboutRumored Buzz on Hard Money AtlantaThe Hard Money Atlanta Ideas

If you can not pay back in time, you ought to refinance the loan into a traditional commercial mortgage to extend the term. Otherwise, you'll lose the home if you back-pedal your finance. So make certain to cover your bases prior to you take this funding choice.Intrepid Private Funding Group provides FAST accessibility to tough cash lending institutions and also is committed to supplying our customers with an individualized service that meets and surpasses their assumptions for a pain-free funding process. Whether you want brand-new building, domestic development, turns, rehabilitation, or other, we can aid you obtain the funds you need quicker than most. hard money atlanta.

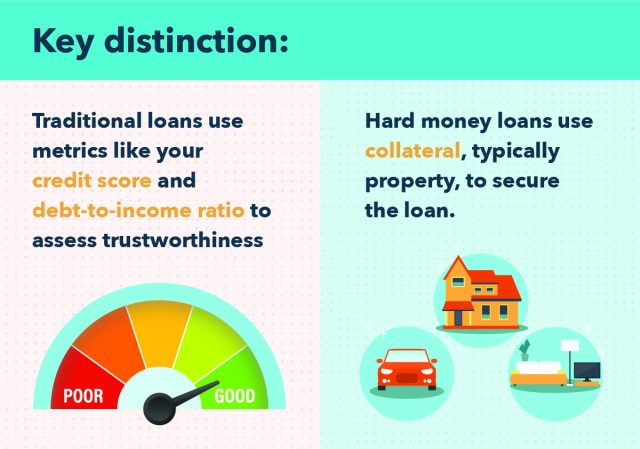

With typical loans, lending institutions normally inspect the customer's ability to repay the funding by taking a look at his/her credit report, FICO credit history, debt-to-income proportion, etc. While some tough money lending institutions may still take these variables right into consideration, most base candidateship on the value of the residential or commercial property. The borrower, for example, might put a home or home that he or she owns - partially or completely - up for collateral.

Rumored Buzz on Hard Money Atlanta

Allow Intrepid Private Capital Team assist you get the exclusive resources that you need for your organization or job. That Requirements a Hard Cash Finance? While anybody can make an application for a tough cash finance, they are best fit for the following: Building fins Purchasers with poor credit scores Customers with little-to-no credit history Investor Residential property designers What is the Loan-to-Value Ratio When thinking about a hard money financing, you need to pay close focus to the costs, funding term, and also most significantly, the loan-to-value proportion.

Contact Us for Added Info Feeling cost-free to call us with any inquiries you have (hard money atlanta). Our friendly staff prepares to assist you get your job off the ground!.

The 6-Minute Rule for Hard Money Atlanta

Hard money financing can be profitable, however similar to any type of business, the possibilities of success rise when certain conditions are satisfied. Difficult cash loaning is much more most likely to be lucrative when: The lending institution recognizes the genuine estate market in the areas where it runs. The lender can efficiently determine, underwrite, manage, and service car loans.Make certain you recognize and also comply click now with any applicable laws as well as needs. If you purchase a difficult money providing fund, check to make certain the fund adheres to relevant guidelines and needs. If you choose to end up being a tough cash loan provider, either straight or with a fund, make certain to comprehend the pertinent earnings and also costs, both vital chauffeurs of success.

Not all difficult cash loan providers bill all these fees. Difficult cash lenders incur expenses, consisting of underwriting lendings, servicing fundings, reporting, marketing to customers as well as investors, and also all the expenses that come with running any type of organization, such as spending for office room and also utilities.

The smart Trick of Hard Money Atlanta That Nobody is Discussing

As tough money lenders in Arizona, we are typically asked if we operate like traditional financial institutions. We do not. One of one of the most usual concerns is "are we a straight loan provider?" That's constantly an outstanding question, as well as whether you choose to function with Capital Fund 1 or otherwise, you ought to ask this to every tough money lending institution you shop in Phoenix az - hard money atlanta.They do not have reputable access to funding, developing a chain of brokers that will most certainly come with a larger quantity of costs. A true difficult cash provider has a source of straight funds, and also no middleman to handle your finance. That's how Funding Fund I works. We solution and also finance all of our click this own loans, offering funds for your financial investment acquisition in behalf of our investors.

Following time you apply for a private mortgage loan, ask if the broker is a straight lending institution or if he is simply the co-broker., like Funding Fund I, is that we carry out all underwriting, paperwork, and finalizings internal, consequently we can money fundings in visit the site 24 hrs as well as even quicker in some circumstances.

Unknown Facts About Hard Money Atlanta

The security is the only point that is underwritten. Because of this and the personal nature of the funds, these kinds of financings are usually able to be moneyed in extremely brief time frames. The major differences between Hard Cash and Standard or Institutional Lending are: Higher Rate Of Interest Much Shorter Car Loan Term Larger Down Settlement Requirements Quicker Financing Funding As a result of the reality that Hard Money loan providers do not underwrite the Debtor their convenience level with the finance originates from equity (or "skin") that the Customer places in the deal.With this in mind, the Hard Money loan provider desires to maintain their car loan total up to a number at which the residential property would probably sell if it was required to trustee sale. Exclusive lending has become among the most safe and most reputable kinds of financing for financial investment home acquisitions.

As a trustee buyer, you don't have a whole lot of time to choose and you absolutely can not linger for the conventional financial institution to money your lending. That takes at the very least thirty day or more, as well as you require to act quickly. You might simply opt to utilize cash available when you go to the trustee public auctions.

The Hard Money Atlanta Ideas

A hard cash loan is an ultramodern, safe finance supplied by an investor to a buyer of a "tough possession," usually realty, whose credit reliability is lesser than the worth of the possession. Hard cash lendings are extra typical for real estate investments buying a rental property or turning a home, for example and can obtain you money rapidly.Report this wiki page